After protracted negotiations taking place on all EU fronts for the past two years, as of both the Parliament’s and Council’s decision of 18 April 2023, maritime transport activity will be included in the European Union Emission Trading System (‘EU ETS’)[1]. The EU ETS forms part of a broad set of laws set to implement the EU’s “Fit for 55” policy package.

The EU Emission Trading Scheme takes the form of a ‘cap-and-trade’ system. A cap is a fixed set threshold which defines the total amount of greenhouse gases (‘GHGs’) that can be emitted by the operators covered by the system. Emissions in the context of the EU ETS only refer to the release of the GHG from ships whilst performing maritime transport activity (Tank-To-Wake). This fixed threshold is progressively reduced at fixed intervals, typically on an annual basis, in line with the EU’s climate target. The way this said cap is translated is in the form of EU allowances (‘EUAs’), wherein one allowance gives the right to emit one tonne of CO2eq (carbon dioxide equivalent). Thus, these allowances represent quantities of regulated GHGs emitted on an annual basis.

Operators and entities which fall within the scope of the EU ETS have a legal obligation to acquire and in turn surrender allowances based on such emissions. Operators are not allowed to generate more GHGs than their allowances can cover. In case where they do, they will have to either purchase more allowances (well in advance of their surrender date) or else be subject to penalties known as an, ’Excess Emissions Penalty’ which currently stands at a rate of 100 EUR for each tonne of Carbon Dioxide equivalent emitted and for which the operator has not surrendered allowances. Payment of the penalty would not release the operator from the obligation imposed to surrender the required allowances. In the case wherein a shipping company fails to comply with these obligations for two or more consecutive reporting periods, the Member States may, after giving the opportunity to the shipping company

concerned to submit its observations, issue an expulsion order.

As obtaining this directive applies only to Ships above 5000 gross tonnes (‘GTs’) which transport cargo or passengers for commercial purposes.

Offshore vessels of 5000 GTs will be included in the ETS from 2027 onwards, whereas general cargo ships and offshore vessels between 400 and 5000 GTs are up for review as early as of 2026 meaning that there is the chance that they too will fall under the ETS in the foreseeable future.

In an attempt to ensure an orderly implementation process, a transitional phase will be established for the surrender of EUAs;

(1) for 2024, 40% of verified regulated GHG emissions to surrender allowances by 30 September 2025;

(2) for 2025, 70% of verified regulated GHG emissions to surrender allowances by 30 September 2026; and

(3) for 2026 onwards, 100% of verified regulated GHG emissions to surrender allowances by 30 September 2027 and by this same date for every following year.

Keeping in mind that this corresponds to an EU directive and is not in itself a legal framework applicable to the whole world, the ETS only applies to particular voyages as outlined hereunder:

(1) 100% of a vessel’s emissions from ships performing voyages between two EU ports of call;

(2) 50% of the emissions from ships performing voyages departing from an EU port to a non-EU port or vice versa

(3) 100% of the emissions from ships at berth in an EU port

As evidenced from the above, the EU ETS makes reference to Ports of Call which it defines as ‘the port where a ship stops to load or unload cargo or to embark or disembark passengers, or the port where an offshore ship stops to relieve the crew…’ The definition follows by stating that stops of containerships in neighbouring container transhipment ports listed in the implementing act, a draft of which has now been issued[2] by the Commission (the ‘Draft’), will be excluded and therefore, any stops made at these ports will not be taken into consideration in terms of the EU ETS. As obtaining, there have been two ports idenitified by the Draft which are; East Port Said in Egypt and Tanger Med in Morocco.

This Draft states that for a port to be identified as a neighbouring container transhipment port and therefore be excluded, it must fulfil the following criteria;

- Must excced 65% of the total container traffic of that port during the most recent twelve-month period

- The port must be located outside the Union but less than 300 nautical miles from a port under the jurisdiction of a Member State

It is stated that a port will not be recognized as a ‘neighbouring container transhipment port’ if it is situated in a third country that implements measures equivalent to the EU ETS.

The EU’s intention is to reduce the risk of evasive port calls by containerships to ports located outside of the EU and relocation of container transhipment activities to ports based outside of the Union. The EU has stated that it believes that evasive port calls will not only diminish the environmental benefits of internalising the cost of emissions for maritime transport activities but can also lead to additional emissions due to the extra distance travelled to evade the requirements of the EU ETS.

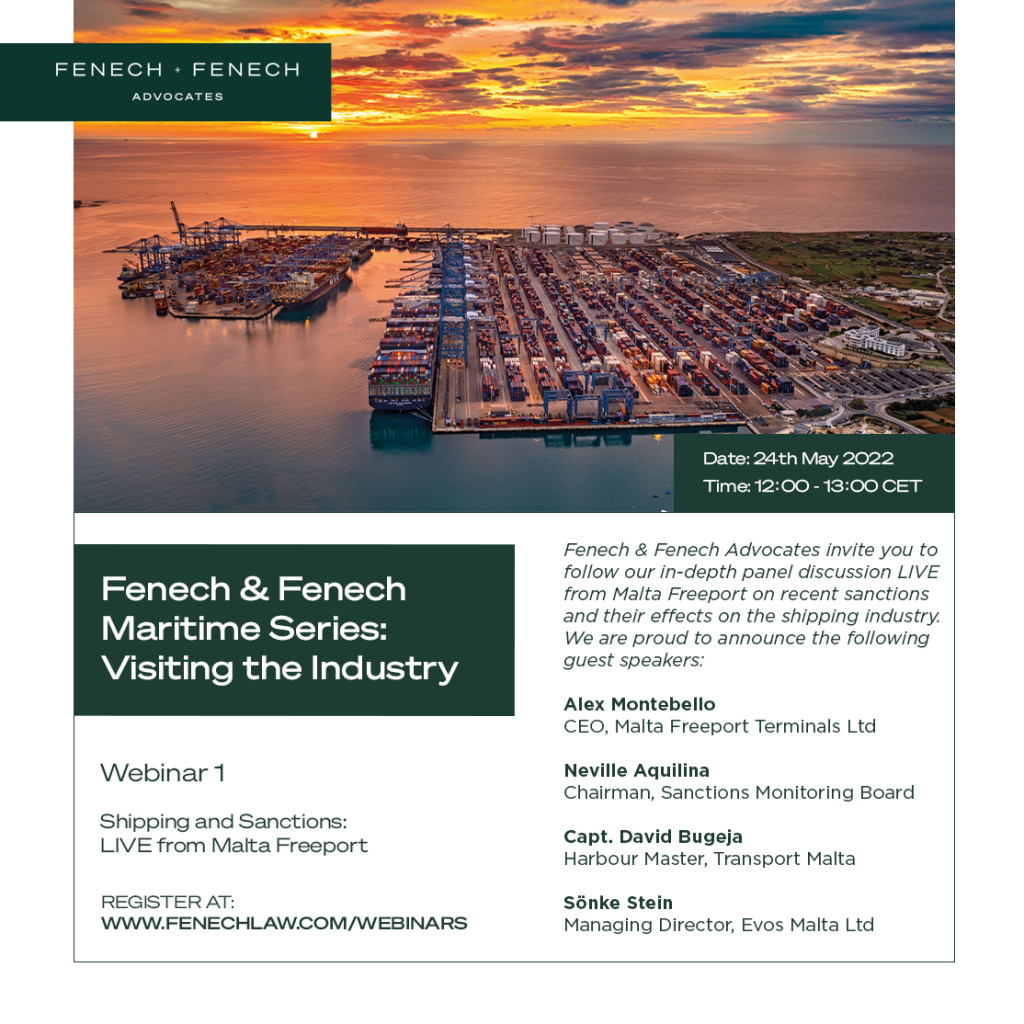

Upon first reading, this Draft might appear as possibly solving the issue of having containerships call at ports outside of the EU with the intention of circumventing the System by surrendering less allowances through such port calls. Upon further examination however, this Draft has its deficiencies and has the potential to defeat the object of the exercise. This is being noted as possibly being the case particularly in the Mediterranean. Notably, shipping operators may choose to intentionally avoid effecting transhipment operations at ports of EU Member States in the Mediterranean altogether and in turn effect their transhipment operations in non-EU ports. If this occurs it will have numerous very serious repercussions. To start with the economies of countries such as Malta which are heavily dependant on maritime activities such as those of Malta Freeport and all the services associated with it will take a battering. Furthermore this re-rerouting may indeed defeat the very object of the exercise behind the ETS in the event that ships deviate to go to North African ports thereby even increasing their carbon footprint. In addition, the termination of transhipment services by mega container vessels from the Far East would seriously impact on the islands connectivity and have a very serious repercussion on imports and exports This is a problem also encountered by Italy and Spain. It is clear that despite the efforts being made through this Draft, alternative solutions must be found sooner rather than later. .

The EU ETS is proposing that 78.4 Million allowances are to be assigned to Maritime Transport Activities by auction. These EUAs are auctioned by the EU amongst participants and the quantity of available allowances relative to total emissions creates a carbon price. The number of available allowances will decrease in a linear manner on an annual basis as one progresses towards the EU’s emissions reduction target.

At the outset, the pertinent question focuses on who is to be considered responsible for compliance and furthermore who is to be considered as the operator? The directive spells this out and states that responsibility lies with the ‘shipping company’. The European Commission’s first draft of an implementing regulation published on the 1st September 2023[3], made it clear that the responsibility encompassing all obligations under EU ETS will most likely fall on the registered ship owner, that is unless the ship owner has successfully contracted out this responsibility to a third party.

It is argued that the EU ETS directive embodies the ‘polluter pays’ principle by granting shipowners the right to recoup any EU ETS compliance costs incurred and this from the particular entity responsible for the ship’s operation. As per the ETS, a ship’s operation takes into consideration, ‘the cargo carried or the route and the speed of the ship’. This right is to apply when there is a contractual arrangement, in place between the shipping company and on the other end the party responsible for the operation of the ship. It is to the company’s commercial benefit to integrate bespoke clauses which ought to be most suitable for the company’s needs.

Nevertheless, the legal responsibility to abide by the ETS rests with the shipping company. Despite there being a contractual structure to help ensure recoupment for the mentioned ETS compliance costs, there exists no option to shift-out the legal responsibility. The duty to abide by the directive is legally binding and no contractual meshwork may entitle a shipping company to shy away from its responsibility.

In a nutshell, advance preparation before the commencement of 2024 is crucial.

It is important for operators to obtain sound advice. Hereunder are three valuable guidelines which we recommend Shipping Companies to embark upon as they approach this ETS era.

Point 1: Understanding the new requirements whilst adapting the existing contract/s.

The EU Commission will not be providing standard clauses to be inserted in the contracts. It is up to the relevant stakeholders to reach an agreement as to the clauses which they wish to incorporate into their contract/s. Stakeholders will have the flexibility to draft clauses with regard to the transfer of costs arising from the surrendering of EU ETS allowances always subject to applicable laws.

Point 2: Finding out which Administering Authority is responsible

Each Shipping Company is to be allocated an Administering Authority by the European Commission (EC). The EC takes it upon itself to decide who is to be considered as the Shipping Company. The first list of companies with their respective Administering Authorities is to be published by the EC by not later than 1 February 2024 and on a biennial basis thereafter. The Administering Authority directly depends on the profile of the relevant Shipping Company. However, in terms of EU-registered companies, if the relevant Shipping Company is registered in the EU, it shall be the Member State in which that company is registered.

Point 3: Establishing an account in the Union Registry

The possibility to open trading accounts with the intention of buying and holding allowances already exists. The process to set up an account can be initiated at once. Despite there being the option to open a Trading Account in any Member State, the ETS stipulates that states can impose certain conditions such as the need for the prospective account holder to have their permanent residence or registration in that same Member State, or alternatively requiring as a condition that the same prospective account holder is registered for VAT in that Member State. Moreover, the Member State may require that at least one of the authorised representatives of an account shall be a permanent resident in that Member State. This is not the case for Malta, Malta does not impose any form of discretionary condition, making it an attractive and accessible state of choice.

It is crucial to underline that the revised ETS Directive and MRV Regulation do not offer all the solutions for the functioning of the EU ETS within maritime transport. Therefore, constant vigilance is required.

Shipping companies should also be attentive of the distinct FuelEU Maritime initiative recently endorsed by the European Commission and the European Parliament. While the final version of the legislation is pending, it is understood that FuelEU Maritime will mandate a gradual reduction in the greenhouse gas intensity of onboard energy for vessels exceeding 5,000 GT. The measures awaiting formal approval are projected to take effect as from 2025 and could potentially present significant commercial and contractual consequences for the entire maritime transport sector.

How can we help?

Should you require any further information or assistance on the matter, please do not hesitate to reach out to us personally on

Ann Fenech – ann.fenech@fenechlaw.com

Daniel-Luc Farrugia – daniel.farrugia@fenechlaw.com

©Fenech & Fenech Advocates 2023

Disclaimer │ The information provided in this article does not, and is not intended to, constitute legal advice. All information, content, and materials available are for general informational purposes only. This article may not constitute the most up-to-date legal or other information and you are advised to seek updated advice.

[1] Directive (EU) 2023/959 amending Directive 2003/87/EC of the European Parliament and of the Council

[2] Draft Commission Implementing Regulation identifying neighbouring container transhipment ports pursuant to Directive 2003/87/EC of the European Parliament and of the Council

[3] “Commission implementing Regulation (EU) laying down rules for application of Directive 2003/87/EC of the European Parliament and of the Council as regards the administration of shipping companies by administering authorities in respect of a shipping company”